As the founder of FinTools UK, one of the most common topics I see causing confusion is how limited company directors in the UK pay themselves. You've built a successful business, but now the question is: what's the most efficient way to take money out? The two main options are a salary (PAYE) or dividends, and the difference between them can have a major impact on your finances.

While taking a salary is straightforward, dividends are often the preferred route for profit extraction due to their tax efficiency. However, the rules, especially with recent changes to allowances, can feel complex. This guide will break down exactly how dividend tax is calculated in the 2025/2026 tax year, helping you understand how your income is assessed and what you might owe.

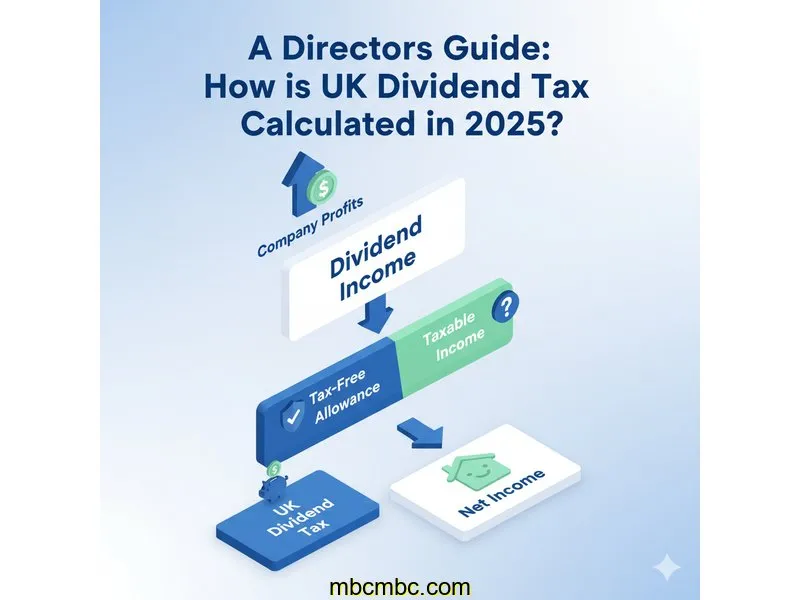

Quick Summary: How Dividend Tax Works

- What is it? A dividend is a payment a company makes to its shareholders (i.e., you, the director) out of its post-tax profits.

- No National Insurance: Unlike salary, dividends are NOT subject to National Insurance contributions (neither employee nor employer). This is their primary tax advantage.

- Tax-Free Allowance: You get a specific Dividend Allowance each tax year. For 2025/26, this allowance is £500. You only pay tax on dividends *above* this amount.

- Tax Rates: Dividend tax is paid at lower rates than income tax. For 2025/26, the rates are 8.75% (for basic rate taxpayers), 33.75% (higher rate), and 39.35% (additional rate).

- How to Pay: Dividend tax is not deducted at source. You must declare your dividend income via a Self-Assessment tax return.

What is a Dividend (and How is it Different from a Salary)?

This is the most critical concept to grasp. A salary is an 'expense' for your limited company. You pay it to an employee (even if that employee is you) for work done. This salary payment is deducted from your company's revenue *before* Corporation Tax is calculated.

A dividend is completely different. It is a distribution of *profit* to the company's owners (shareholders). It can only be paid *after* your company has paid all its expenses (including any salaries) and, crucially, after it has paid or accounted for its Corporation Tax bill.

Think of it this way:

- A Salary is like paying a chef to work in your restaurant. It's a cost of doing business.

- A Dividend is like sharing the restaurant's end-of-year profits with the investors who own it.

This distinction is why dividends are not subject to National Insurance—they aren't "earnings" from employment in the same way a salary is.

The 4-Step Process: How Dividend Tax is Calculated

Calculating your personal dividend tax bill involves a clear, four-step process. The key is to remember that your dividend income "sits on top" of all your other income (like your small director's salary) to determine which tax band it falls into.

Step 1: Add Up All Your Income

First, you need your total income for the tax year. This includes your director's salary, any dividends you've taken, and any other income (perhaps from property or savings).

Example: You pay yourself a salary of £12,570 and take £30,000 in dividends. Your total income is £42,570.

Step 2: Apply Your Allowances

You have two separate allowances working for you:

- Personal Allowance (£12,570): This is used up first by your non-dividend income (i.e., your salary). In our example, your £12,570 salary uses your £12,570 Personal Allowance perfectly, meaning you pay no income tax on it.

- Dividend Allowance (£500): This is a separate, specific allowance for dividends. The first £500 of your dividends are 0% tax, regardless of your tax band.

Step 3: See Which Tax Band Your Dividends Fall Into

This is where it gets technical. Your £12,570 salary has already used up the first part of your basic rate tax band. The 2025/26 tax bands are:

- Basic Rate: £12,571 to £50,270

- Higher Rate: £50,271 to £125,140

- Additional Rate: Over £125,140

In our example, your £12,570 salary uses the band up to that amount. Your £30,000 of dividends "sits on top," starting from £12,571. Since the higher rate threshold is £50,270, all of your dividends (£30,000) fall entirely within the basic rate band.

Step 4: Apply the Correct Dividend Tax Rates

Now you can apply the 2025/26 dividend tax rates to the taxable portion:

- Total Dividends: £30,000

- Use £500 Dividend Allowance: £500 is taxed at 0%.

- Taxable Portion: £30,000 - £500 = £29,500.

- Apply Rate: This £29,500 all falls in the basic rate band, so it's taxed at 8.75%.

- Total Tax Bill: £29,500 * 0.0875 = £2,581.25.

This £2,581.25 is the personal tax you would owe on your dividends, payable via Self-Assessment.

Scenario: Salary vs. Small Salary + Dividends

So why go through all this? The tax saving. Let's compare taking £50,000 of profit out of your company in two different ways. The table below illustrates the significant difference in taxes paid and your final take-home pay. This scenario assumes a 19% Corporation Tax rate and 2025/26 tax/NI rates.

| Metric | Scenario A: £50,000 as 100% Salary | Scenario B: £12,570 Salary + Dividends |

|---|---|---|

| Company Profit | £50,000 | £50,000 |

| Salary Paid | £50,000 | £12,570 |

| Employer's NI (Company Cost) | £5,217 | £0 (below threshold) |

| Corporation Tax (Company Cost) | £0 (Salary is an expense) | £7,112 (on profit after salary) |

| Profit for Dividend | £0 | £30,318 |

| Personal Taxes | ||

| Income Tax (on Salary) | £7,486 | £0 (covered by Personal Allowance) |

| Employee's NI (on Salary) | £2,994 | £0 (below threshold) |

| Dividend Tax (on Dividends) | N/A | £2,609 (on £29,818 @ 8.75%) |

| Total Tax (Company + Personal) | £15,697 | £9,721 |

| Final Take-Home Pay | £34,303 | £40,279 |

As the table clearly shows, in this scenario, using the small salary and dividend combination results in over £5,900 more in your personal bank account, all from the same £50,000 of company profit. This is the power of understanding the dividend tax system.

How Calculators Help Understand Dividend Tax

While the example above is simplified, real-life scenarios can be much more complex. You might have other income, be on the edge of a tax-threshold, or want to see the impact of the new £500 allowance. This is where a dedicated dividend tax calculator becomes an invaluable tool.

Using a calculator allows you to:

- Model Different Scenarios: Instantly see the tax impact of taking £10,000 more in dividends versus £10,000 more in salary.

- Prepare for Your Tax Bill: Get a reliable estimate of what you'll owe in your Self-Assessment, so there are no surprises on January 31st.

- Understand Tax Bands: A good calculator will show you exactly how much of your dividend income falls into the basic, higher, and additional rate bands.

- Find Your "Sweet Spot": You can experiment with different salary and dividend combinations to see how your take-home pay is affected, helping you plan your profit extraction strategy for the year.

Common Questions About UK Dividend Tax

The world of director's pay is full of specific questions. Here are some of the most common ones I've come across from real users.

Do I pay National Insurance on my dividends?

No. This is the single biggest advantage of dividends. They are not subject to Employee's or Employer's National Insurance contributions. This is why the mixed salary/dividend model in the table above is so much more efficient.

Does the £500 dividend allowance stack with my £12,570 Personal Allowance?

Yes, they are two separate allowances. Your Personal Allowance (£12,570) is typically used against your non-dividend income (like your salary). The Dividend Allowance (£500) is then applied specifically to your dividend income. This means you can earn your £12,570 salary tax-free and *also* take your first £500 of dividends tax-free.

How do I physically pay the tax I owe on my dividends?

Unlike PAYE salary where tax is deducted at source, dividend tax is not. You are responsible for calculating and paying it yourself. You must declare all dividend income over £500 on a Self-Assessment tax return each year. HMRC will use this return to calculate your total tax bill (including your dividend tax), which you must then pay by the deadline, usually 31st January.

Final Thoughts

For limited company directors in the UK, using a dividend strategy remains one of the most tax-efficient ways to extract profits from your business. However, the shrinking tax-free allowance (down to £500 for 2025/26) means that planning and understanding the calculation is more important than ever. More directors will find themselves paying dividend tax, even at relatively low levels of profit.

By understanding that dividends are paid from post-tax profit, are not subject to NI, and are taxed based on where they "sit on top" of your other income, you can make informed decisions. Using calculators and planning ahead with your Self-Assessment can remove the stress and ensure you are prepared for your tax bill, with no nasty surprises.

Disclaimer: I'm Alex, the developer behind FinTools UK. The information provided in this article is for informational purposes only and is based on UK tax rules for the 2025/2026 tax year. It does not constitute financial or tax advice. You should always consult with a qualified accountant or financial advisor to discuss your specific circumstances and to ensure you are complying with all HMRC regulations. Tax rules can and do change, so it's essential to get professional advice.