Hello, I'm Alex Williams, founder of FinTools UK. If you've recently registered your small business for VAT, you've suddenly entered a new world of terminology. Two of the most critical terms you'll now see everywhere are "Input VAT" and "Output VAT." It can feel a bit like learning a new language, but the core concept is actually very straightforward.

These two terms represent the two sides of your VAT responsibilities: the VAT you *collect* from your customers and the VAT you *pay* on your own business purchases. Getting these two a clear understanding of these two is fundamental to managing your business cash flow and correctly filing your VAT returns with HMRC.

In this article, we'll break down exactly what Input and Output VAT mean, provide a step-by-step guide on how they interact, and walk through a clear example. The goal isn't to provide financial advice, but to demystify the mechanics behind the process, helping you feel more confident in your bookkeeping.

Quick Summary

- Output VAT is the VAT you add to your sales invoices and *collect* from your customers. You are essentially holding this money on behalf of HMRC.

- Input VAT is the VAT you *pay* on your business-related purchases and expenses. You can typically reclaim this amount from HMRC.

- Your VAT Return calculates the difference: (Total Output VAT) minus (Total Input VAT). This determines whether you make a payment *to* HMRC or receive a refund *from* them.

Understanding Output VAT: The "Collection" Side

Output VAT is the VAT you charge on your own sales of goods and services (known as "taxable supplies"). When you become VAT-registered, you are legally required to add the appropriate VAT rate (e.g., 20% standard rate) to your prices.

Think of yourself as a temporary "collection agent" for HMRC. If you are a graphic designer and you charge a client £1,000 for a project, you must add 20% VAT (£200) to the invoice. The total invoice your client pays is £1,200.

That £200 VAT you've collected is *not* your revenue. It's money you are holding temporarily before you "output" it to HMRC, usually on a quarterly basis. This is why it's called Output VAT—it's the VAT associated with your business's output (your sales).

Understanding Input VAT: The "Reclaim" Side

Input VAT is the opposite. It's the VAT you *pay* when your business buys goods or services (its "inputs"). This could include things like a new laptop, stock, software subscriptions, or accounting fees.

If Output VAT is money you collect for HMRC, you can think of Input VAT as a "rebate" or "credit" you get back from them. Because you are a VAT-registered business, you are part of a chain. The VAT system is designed so that the final cost is ultimately paid by the end consumer, not by the businesses in the middle.

Therefore, when your business buys a new computer for £800 + £160 VAT, that £160 is your Input VAT. You can "reclaim" this amount by deducting it from the Output VAT you've collected. To do this, you must have a valid VAT invoice from your supplier as proof of purchase.

The Core Process: A Step-by-Step Guide to How They Interact

The entire VAT return process is simply the act of reconciling these two figures. Here is the step-by-step flow, typically done every three months (your "VAT quarter"):

- Step 1: Collect Output VAT. Throughout your VAT quarter, every time you make a sale to a customer, you issue an invoice that includes VAT. You collect this money and keep a record of the total Output VAT you've charged.

- Step 2: Pay and Record Input VAT. At the same time, whenever you make a business purchase from another VAT-registered business, you pay their VAT. You collect these VAT invoices and keep a record of the total Input VAT you've paid.

- Step 3: Calculate the Totals. At the end of your quarter, you add up all your Output VAT from your sales. You also add up all your reclaimable Input VAT from your purchases.

- Step 4: Find the Difference. You then perform one simple calculation:

(Total Output VAT) - (Total Input VAT) = Your VAT Bill or Refund - Step 5: File Your VAT Return and Settle. You report these two totals to HMRC via your VAT return.

- If your Output VAT is *more* than your Input VAT, you pay the difference to HMRC.

- If your Input VAT is *more* than your Output VAT, you claim a refund for the difference from HMRC.

A Worked Example: A Small Business Owner's First VAT Quarter

Let's imagine "Brighton Web Build," a small web design agency, has just completed its first VAT quarter. Here are its figures:

1. Output VAT (Money Collected)

Brighton Web Build completed two projects this quarter:

- Project A (Local Bakery): £4,000 (service fee) + £800 (20% VAT) = £4,800 Total

- Project B (Consultancy): £6,000 (service fee) + £1,200 (20% VAT) = £7,200 Total

Total Output VAT Collected: £800 + £1,200 = £2,000

2. Input VAT (Money Paid)

The business also had several expenses:

- New Office Laptops: £1,500 (cost) + £300 (20% VAT)

- Quarterly Software Subscriptions: £500 (cost) + £100 (20% VAT)

- Accountant's Fees: £400 (cost) + £80 (20% VAT)

Total Input VAT Paid: £300 + £100 + £80 = £480

3. The Final Calculation

At the end of the quarter, the business files its VAT return:

- Total Output VAT (Box 1): £2,000

- Total Input VAT (Box 4): £480

- Calculation: £2,000 (Output) - £480 (Input) = £1,520

In this scenario, Brighton Web Build will make a VAT payment of £1,520 to HMRC for the quarter.

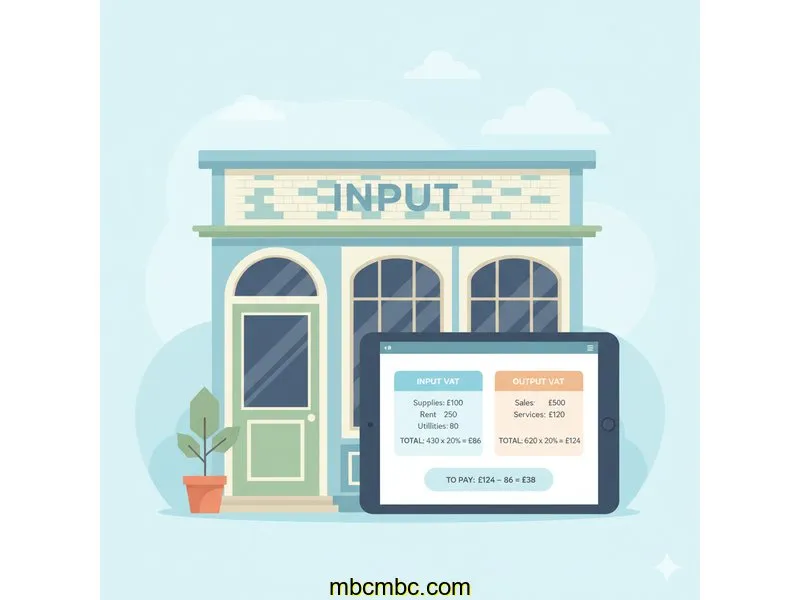

Using a Calculator to Visualise Your VAT Position

An online VAT calculator is an educational tool that can help model these numbers. It's a simple way to see this process in action. By inputting your total sales (to see the resulting Output VAT) and your total business purchases (to see the reclaimable Input VAT), you can get a clearer picture of how the final calculation works.

This article is intended to explain the mechanics of the system. Using a tool like our VAT Calculator can help bring those mechanics to life and demonstrate how different levels of sales or expenses can change the final figure you owe or are owed.

Common Questions About Input vs. Output VAT

What happens if my Input VAT is higher than my Output VAT in a period?

This is a common situation, especially for new businesses making large one-off purchases (like equipment or stock) or if you've had a quarter with low sales. In this case, you are due a VAT refund from HMRC. You still file your return as normal, and the final figure will be negative, indicating a repayment *to* you.

Can I claim Input VAT on all my business purchases?

Not always. You can generally only reclaim VAT on goods and services that are used for your business. There are specific rules for items that have mixed personal and business use (like a mobile phone or car). Furthermore, some items are "VAT exempt" (like insurance or postage stamps), meaning they don't have Input VAT to reclaim in the first place.

How does this process work with the VAT Flat Rate Scheme?

The Flat Rate Scheme is a simplification. If you use this scheme, you *ignore* the Input vs. Output VAT calculation for the most part. Instead, you pay a single, fixed (and lower) percentage of your total VAT-inclusive turnover to HMRC. The trade-off is that you generally *cannot* reclaim any Input VAT on your purchases (with a few exceptions for very large capital assets).

Conclusion: A Clear Flow of Information

Understanding the distinction between Input VAT (what you pay and can reclaim) and Output VAT (what you collect and must pay) is the foundation of the UK's VAT system. Once you see it as a simple flow—money in from purchases, money out from sales—the process becomes much less intimidating.

We hope this step-by-step guide and the worked example provide a clearer understanding of the mechanics. By keeping accurate records of both your sales and your purchases (with their VAT invoices), you'll have the two key figures you need to complete your VAT return accurately.

All information in this article is for educational purposes only and should not be considered financial advice. As the developer of FinTools UK, my goal is to provide informational clarity. You should always consult with a qualified financial professional before making any financial decisions.