UK Tax Calculators Made Simple

Quickly estimate your take-home pay after Income Tax and National Insurance. Use our detailed calculators for more options. Updated for 2024/25 UK rates.

Quick Take-Home Pay Estimator

(England/NI/Wales - 2024/25)

Complete Financial Calculator Suite

All the tools you need in one place.

From The FinTools UK Blog

Our latest insights and guides on UK finance.

A Director's Guide: How UK Dividend Tax Works (2025/26 Rates)

Posted on October 17, 2025

If you're a director of your own limited company in the UK, one of the first and most important concepts you'll encounter is the dividend....

Read More →

How to Pay Yourself from a UK Limited Company: A 2025 Salary vs. Dividend Scenario

Posted on October 24, 2025

If you've recently set up your own UK limited company, congratulations! You've navigated the first set of hurdles. Now comes one of the most common...

Read More →

How Do UK Dividend Tax Rates Work in 2025? A Guide for Limited Company Directors

Posted on October 20, 2025

As a limited company director in the UK, you've likely heard endless discussions about the "most tax-efficient" way to pay yourself. This almost always involves...

Read More →

Selling Your Home vs. a Buy-to-Let: A UK Guide to Capital Gains Tax Reliefs

Posted on October 16, 2025

Selling a property in the UK can be a significant financial event. For many, the profit (or 'gain') unlocked from a sale is a welcome...

Read More →

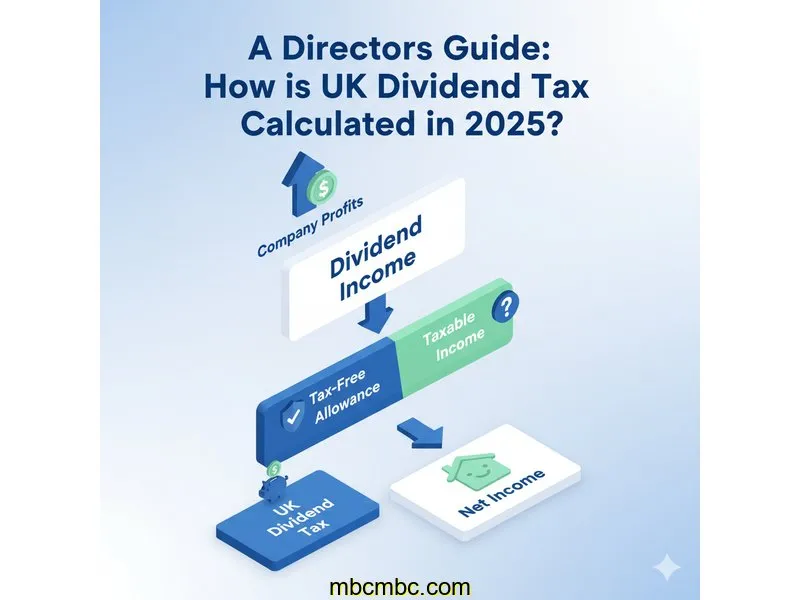

A Director's Guide: How is UK Dividend Tax Calculated in 2025?

Posted on October 19, 2025

As the founder of FinTools UK, one of the most common topics I see causing confusion is how limited company directors in the UK pay...

Read More →

Navigating the 2025/26 UK Company Car Tax: A Comparison of Electric vs. Fuel BIK for SMEs

Posted on October 18, 2025

If you're a small business owner or an employee considering a company car in the UK, the choice is more complex than just picking your...

Read More →

The UK VAT Flat Rate Scheme: Is It Right for Your Small Business? A Comparative Guide to FRS vs Standard VAT

Posted on October 22, 2025

Hi, I'm Alex from FinTools UK. Dealing with VAT can feel like navigating a maze, especially when you’re a small business owner trying to focus...

Read More →

UK Company Car Tax 2025: An EV vs. Petrol Calculation Showdown

Posted on October 16, 2025

Hi, I'm Alex Williams, founder of FinTools UK. If you're an employee choosing a new company car or a business owner deciding what to offer...

Read More →

The £1 Million IHT Myth: A Clear Guide to the UK Residence Nil-Rate Band (RNRB)

Posted on October 24, 2025

Hello, I'm Alex Williams, founder of FinTools UK. As a developer, I'm passionate about building tools that make complex financial topics clearer. One of the...

Read More →

How to Plan Your Limited Company Dividends in 2025: A Small Business Guide

Posted on October 16, 2025

Hi, I'm Alex Williams, founder of FinTools UK. As a developer, I love breaking down complex financial topics. One of the most common areas of...

Read More →

Moving Home with a Fixed Mortgage? Understanding Porting vs. Paying ERCs

Posted on October 16, 2025

Hi, I'm Alex Williams, founder of FinTools UK. As a developer, I love breaking down complex processes into simple, understandable parts. One of the most...

Read More →

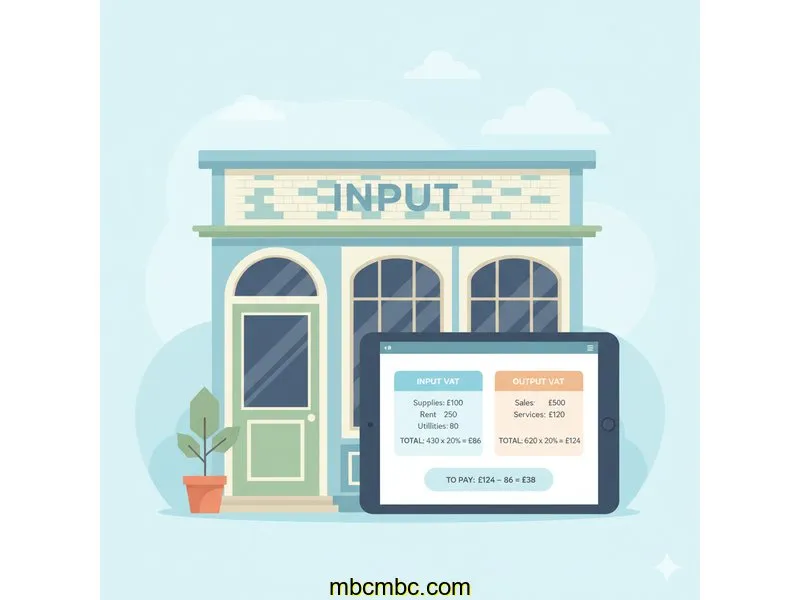

Input VAT vs. Output VAT: A Clear Step-by-Step Guide for Small Business Owners

Posted on October 28, 2025

Hello, I'm Alex Williams, founder of FinTools UK. If you've recently registered your small business for VAT, you've suddenly entered a new world of terminology....

Read More →

Input VAT vs. Output VAT: Common Myths vs. Reality for UK Small Business Owners

Posted on October 28, 2025

Hello, I'm Alex Williams, founder of FinTools UK. As a developer, I love building tools to simplify complex topics. One of the most significant hurdles...

Read More →